In the low-interest-rate environment, market opportunity is not confined to a single state or region. To maximize revenue, lenders must be able to originate and close loans wherever the borrower is located. However, rapidly scaling into new territories is often impeded by the challenge of finding, vetting, and contracting compliant title partners. Tier 1 Title removes this barrier completely.

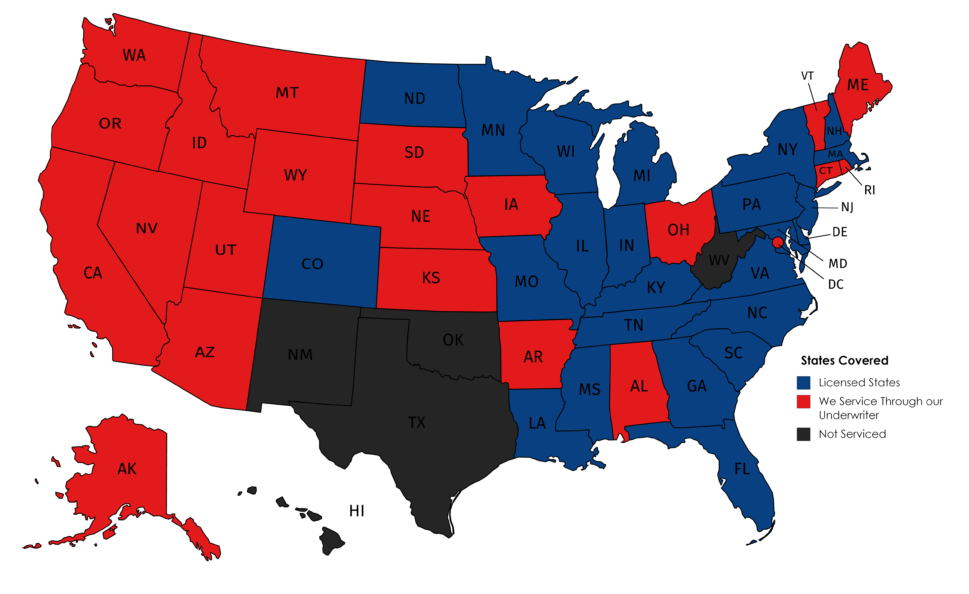

As a true national title company 45 states rely on, Tier 1 Title is authorized and operational across virtually the entire United States. This provides immediate, full title coverage 45 states wide, eliminating the need for costly and time-consuming vendor onboarding.

Unconstrained Growth and Market Agility

This extensive operational footprint is the key to empowering lenders to scale mortgage business nationally. You no longer need to restrict your marketing or loan officer recruiting based on title vendor availability. You can launch aggressive refinance campaigns into any of the 45 authorized states knowing that your title partner is ready and compliant from day one.

Furthermore, this coverage guarantees a seamless experience for your borrowers. Whether they are refinancing a vacation home in Arizona or a primary residence in New Jersey, they receive the same professional, high-standard service from your dedicated Tier 1 Title team. This uniformity protects your brand integrity during the expansion phase. Tier 1 Title provides the essential, pre-built infrastructure required for ambitious lenders seeking to capture the largest possible market share during this period of high volume.